Step 3: Prepare and submits the documents required to obtain preferential tariff treatment to Japan Customs upon import declaration

The Proof of Origin procedures applicable to imports to Japan can be conducted using any of the following systems.

| Proof of Origin | Eligible exporting Parties | Documents to be submitted | ||

|---|---|---|---|---|

| 1 | Importers | Self-Certification (Self-Declaration) system | All Parties | Declaration of Origin, Attachment for the Declaration of Origin, other relevant documents |

| 2 | Exporters Producers |

Australia New Zealand |

Declaration of Origin, Attachment for the Declaration of Origin, other relevant documents |

|

| 3 | Approved Exporter Self-Certification system | All Parties | Declaration of Origin prepared by an approved exporter designated as such by the competent authority of the exporting Party | |

| 4 | Third party certification system | All Parties | Certificate of Origin *The exporter or producer requests a Proof of Origin from the competent issuing body of the exporting Party |

|

The four proof of origin systems listed above are described in detail in the following section. The need to determine the RCEP Country of Origin is common, however, to all of the aforementioned systems.

RCEP Country of Origin

Under the RCEP Agreement, the tariff rates applied to an originating good intended for import may differ depending on its classification or Party; in such circumstances, the tariff rate applied to any such originating good is that defined for its respective RCEP Country of Origin as per the provisions of Article 2.6.

One of the Minimum Information Requirements to evidence Proof of Origin under the RCEP Agreement is the Country of Origin, and this information will be indicated on any Certificate of Origin issued by the issuing body of the exporting Party, any Declaration of Origin prepared by an Approved Exporter, or any Declaration of Origin prepared by an Exporter or Producer utilizing the Self-Certification (Self-Declaration) system.

Importers utilizing the Importer Self-Certification (Self-Declaration) system must also identify and indicate the RCEP Country of Origin on the Declaration of Origin.

In many instances, the RCEP Country of Origin for an originating good shall be the Party where the good acquired its originating status in accordance with the RCEP Agreement; ordinarily, this is the exporting Party. In some instances, however, a Party other than the exporting Party could be designated the RCEP Country of Origin. In the event that there is a tariff differential applicable to a good intended for import and the good meets criteria (a) or (b) as described below, a Party other than the exporting Party may be the RCEP Country of Origin. As such, Importers are advised to refer to the document titled “RCEP Country of Origin.”

(a) The 9-digit HS Code and Subdivision of the good is identified in an Appendix in Relation to Article 2.6.3 (Tariff Differentials)

【Appendix in Relation to Article 2.6.3 (Tariff Differentials)】

(b) The good meets the criteria of “a good produced exclusively from originating materials” as defined under Article 3.2 (b)

1. Declaration of Origin conducted by an importer (Importer Self-Certification (Self-Declaration) system)

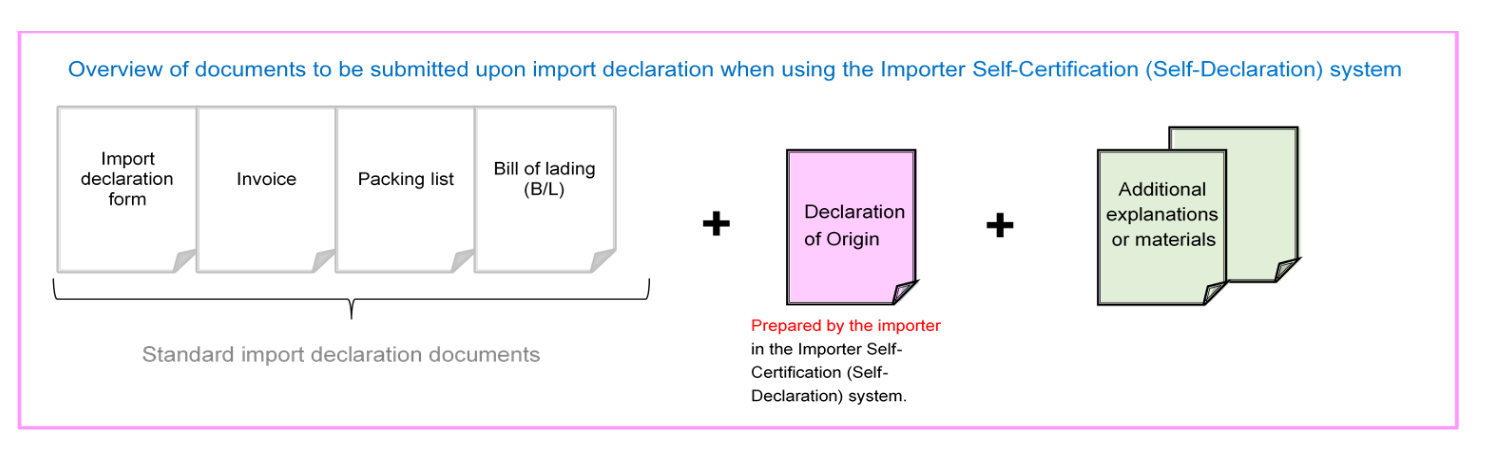

The Importer Self-Certification (Self-Declaration) system allows the importer to prove the originating status of a given good by preparing and submitting a Declaration of Origin to Japan Customs. Under the RCEP Agreement, the Importer Self-Certification (Self-Declaration) system can only be used in relation to imports into Japan.

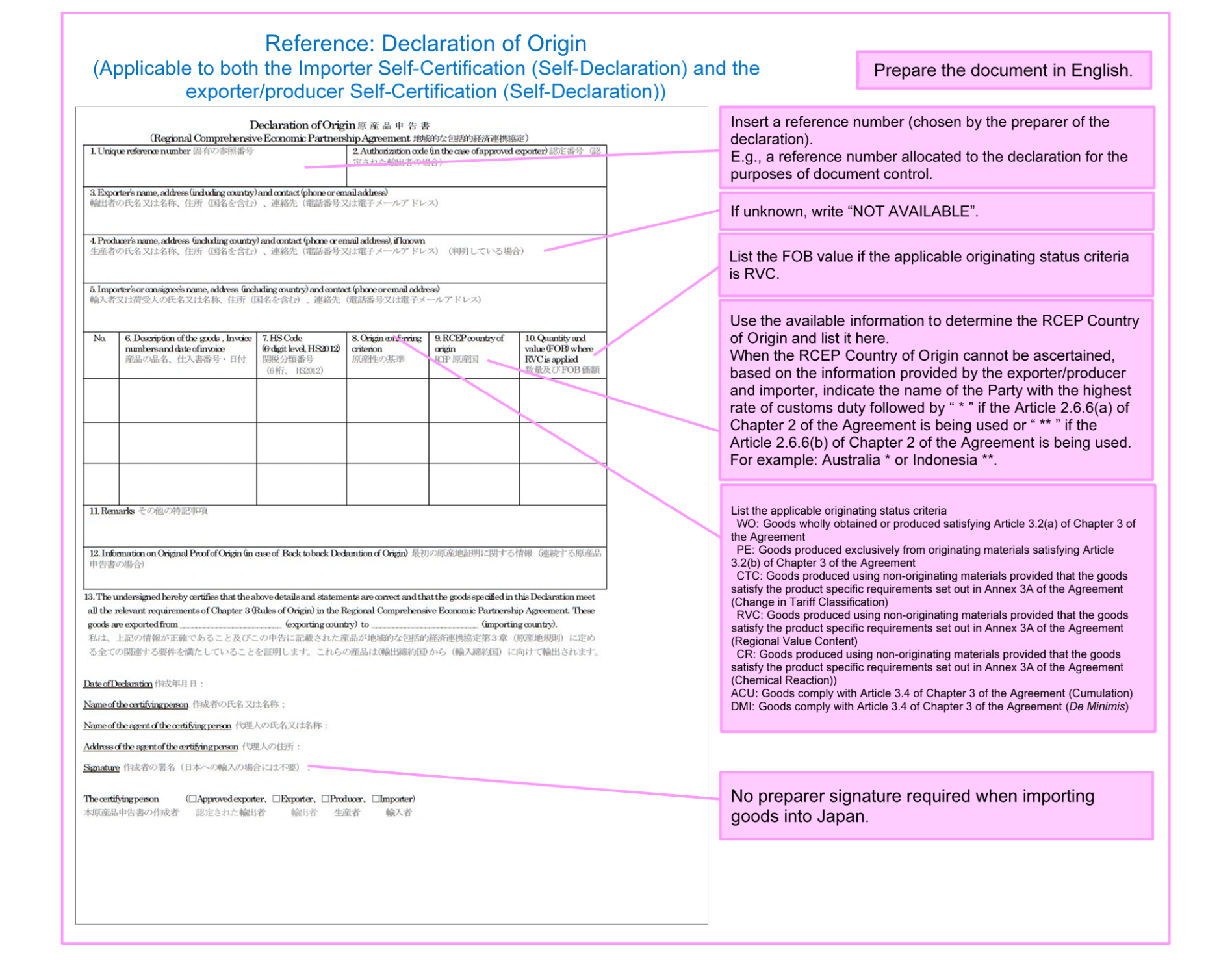

The Importer Self-Certification (Self-Declaration) system allows an importer to prepare a Declaration of Origin, provided that said importer has sufficient information to prove the originating status of the good intended for import into Japan. Provided that the Minimum Information Requirements stipulated in Annex 3B 2. Declaration of Origin are recorded on the document, the Declaration of Origin can be prepared in any format. The document shall be prepared in English.

【Annex 3B: Minimum Information Requirements】

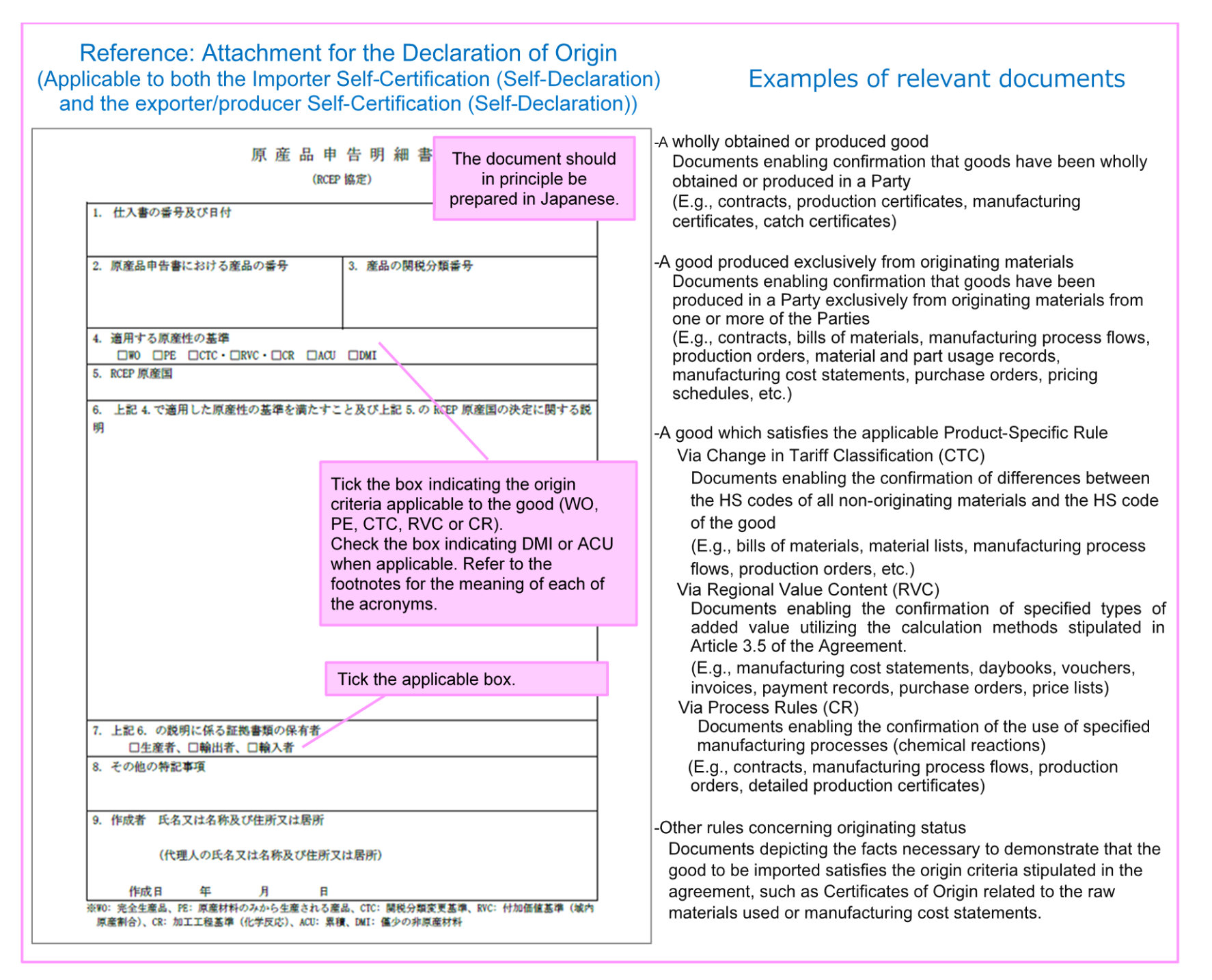

In addition to the Declaration of Origin, Japan requires importers to submit documents (collectively referred to below as “additional explanations” or “additional materials”) evidencing the originating status of the good (i.e., an Attachment for the Declaration of Origin and any related documents which can be used to verify the details of the Attachment for the Declaration of Origin (including contracts, pricing schedules, bills of materials, and production flow charts). There is no standardized format stipulated for the Attachment for the Declaration of Origin.

Examples of the Declaration of Origin and Attachment for the Declaration of Origin are available on the Japan Customs website (via the Rules of Origin portal).

[Declaration of Origin: Sample/Instructions]

[Attachment for the Declaration of Origin: Sample {Japanese/English}/Instructions]

For details on the Importer Self-Certification (Self-Declaration) system, please refer to the RCEP Agreement: Guideline on Self-Certification System.

【RCEP Agreement: Guideline on Self-Certification System】

2. Declaration of Origin conducted by an exporter or producer (Exporter Self-Certification (Self-Declaration) system)

The Exporter Self-Certification (Self-Declaration) system allows the importer to prove the originating status of a given good by submitting a Declaration of Origin prepared by the exporter or producer to the Japan Customs. The Exporter Self-Certification (Self-Declaration) system can be utilized only when both the exporting Party and importing Party have adopted the system.

The Exporter Self-Certification (Self-Declaration) system allows an exporter or producer to prepare a Declaration of Origin provided that said exporter or producer holds sufficient information to prove the originating status of the good. Provided that the Minimum Information Requirements stipulated in Annex 3B 2. Declaration of Origin are recorded on the document, the Declaration of Origin can be prepared in any format. The document shall be prepared in English.

[Annex 3B: Minimum Information Requirements]

[Declaration of Origin: Sample / Instructions]

In addition to the Declaration of Origin, Japan Customs requires the submission of additional explanations or materials evidencing the originating status of the good. There is no standardized format stipulated for the Attachment for the Declaration of Origin.

[Attachment for the Declaration of Origin: Sample {Japanese/English)/Instructions]

In the event that the importer is unable to obtain and submit additional explanations and materials to Japan Customs, the importer is to use any available information to prepare an Attachment for the Declaration of Origin, (e.g. documents concerning the methods by which the originating status of the good was verified) and the importer is furthermore to provide an accompanying statement to the effect that sufficient levels of information could not be obtained due to trade secrets or other factors.

However, importers are advised to exercise due caution, as importers are responsible for verifying that the goods are originating goods even when utilizing the Exporter Self-Certification (Self-Declaration) system.

The stipulations concerning the Declaration of Origin and Attachment for the Declaration of Origin under the Exporter Self-Certification (Self-Declaration) system are equivalent to those described above in 1. Importer Self-Certification (Self-Declaration) system;

examples of these documents are available on the Japan Customs website (via the Rules of Origin portal).

For details on the Exporter Self-Certification (Self-Declaration) system, please refer to the RCEP Agreement: Guideline on Self-Certification System.

[RCEP Agreement: Guideline on Self-Certification System]

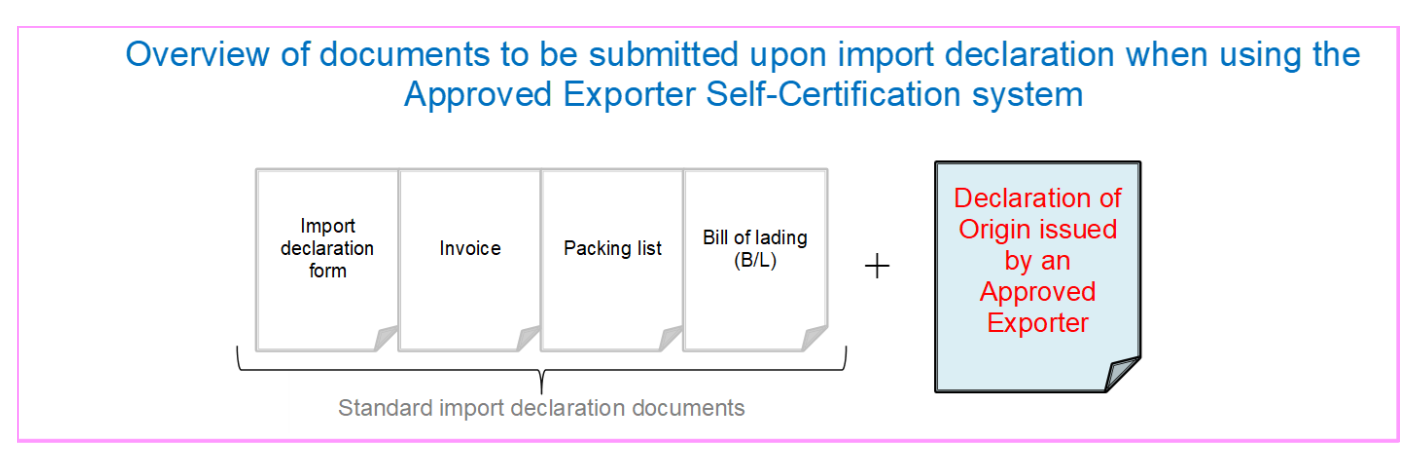

3. Declaration of Origin issued by an Approved Exporter (Approved Exporter Self-Certification system)

The Approved Exporter Self-Certification system allows an importer to prove the originating status of a given good by submitting a Declaration of Origin prepared by an exporter that has received approval from the competent authorities of the relevant Parties to Japan Customs.

Annex 3B 2. Declaration of Origin stipulates the Minimum Information Requirements applicable to the RCEP Declaration of Origin. Provided that the Minimum Information Requirements are recorded on the document, the Declaration of Origin can be prepared in any format, as no format is specified in the Agreement. The document shall beprepared in English.

[Annex 3B: Minimum Information Requirements]

When using the Approved Exporter Self-Certification system, the only additional document required beyond the standard import declaration documents submitted to Japan Customs upon import declaration is the Declaration of Origin, and the submission of additional explanations or materials is not required.

However, importers are advised to exercise due caution, as importers are responsible for verifying that the goods are originating goods even when utilizing the Approved Exporter Self-Certification system.

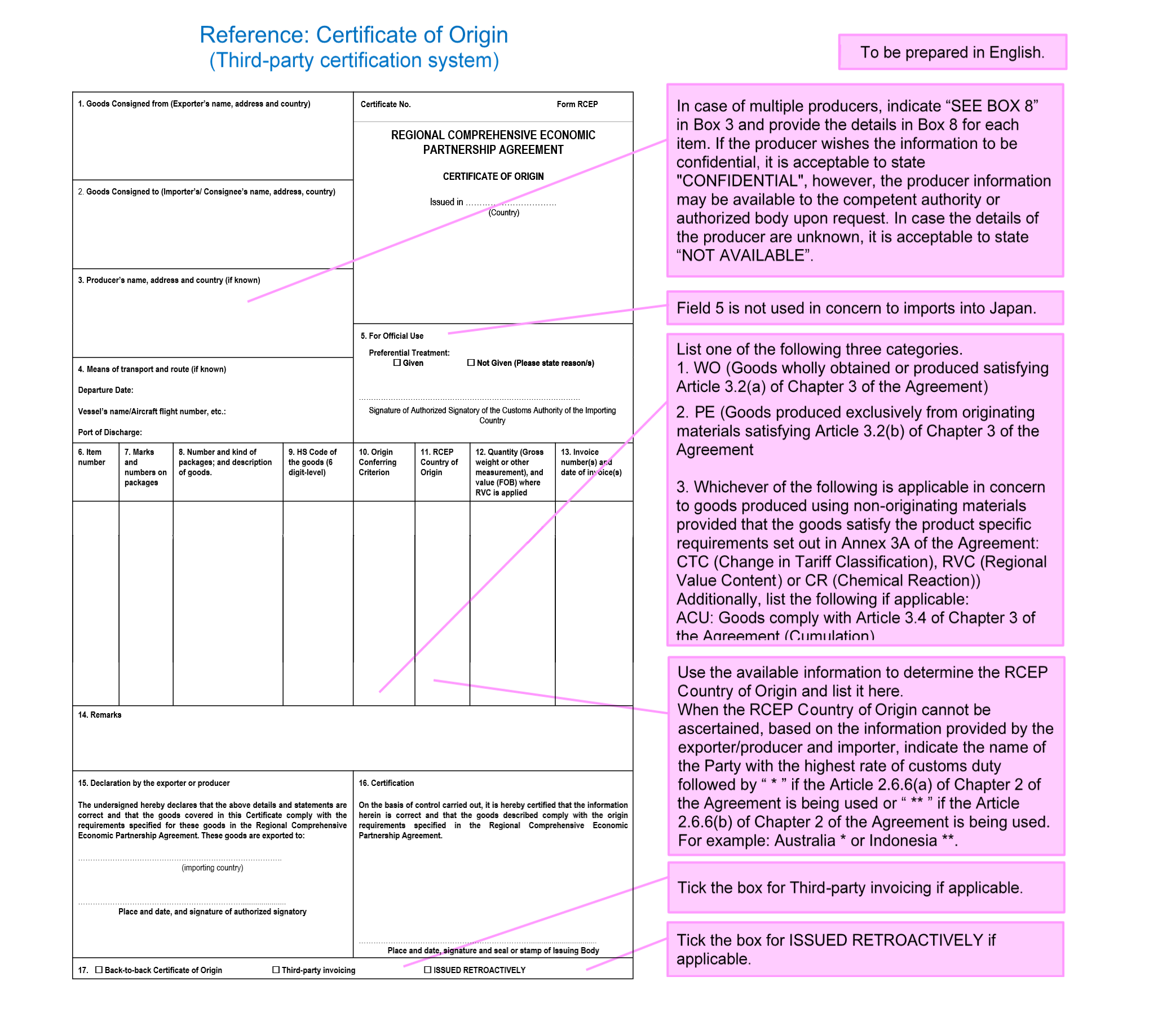

4. Certificate of Origin issued by a competent issuing body (Third party certification system)

This system allows the importer to prove the originating status of a given good by submitting a Certificate of Origin prepared by the issuing body of the exporting Party at the request of either the exporter, producer, or an agent thereof, to Japan Customs.

Annex 3B 1. Certificate of Origin stipulates the Minimum Information Requirements applicable to the RCEP Certificate of Origin.

[Annex 3B: Minimum Information Requirements]

Refer to the Japan Customs website (the Rules of Origin portal) for the list of Certificate of Origin issuing bodies authorized by the Parties.

[List of Certificate of Origin issuing bodies for Each EPA]

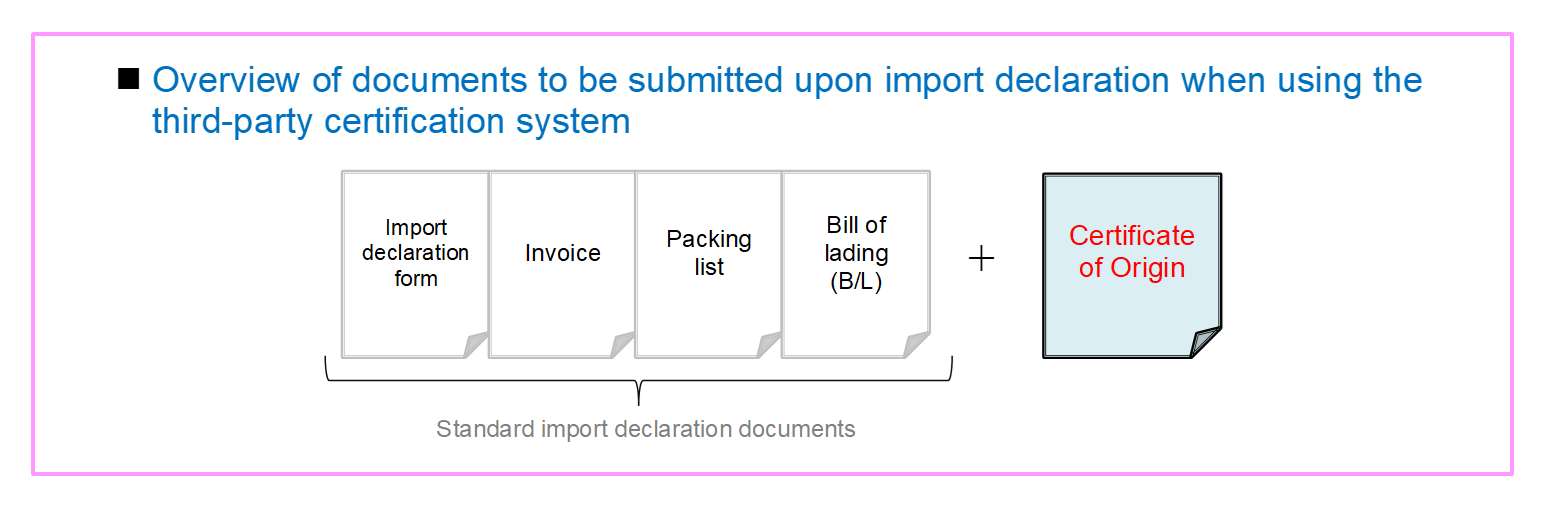

When using the third-party certification system, the only additional document required beyond the standard import declaration documents submitted to Japan Customs upon import declaration is the Certificate of Origin, and the submission of additional explanations or materials is not required.

However, importers are advised to exercise due caution, as importers are responsible for verifying that the goods are originating goods even when utilizing the third-party certification system.

5. Forgoing submission

(1) Forgoing submission of a Declaration of Origin, Declaration of Origin issued by an Approved Exporter and Certificate of Origin

Irrespective of which of the Proof of Origin methodologies depicted above is utilized, the importer may forgo submission of a Declaration of Origin, Declaration of Origin issued by an Approved Exporter and Certificate of Origin when the customs value of the imported goods amounts to JPY200,000 or less.

(2) Forgoing submission of additional explanations or materials

Forgoing of the submission of additional explanations or materials is permitted in the following circumstances:

■When the forgoing of the submission of a Declaration of Origin is permitted as per (1)

■ A relevant advance ruling on origin has been obtained (in writing), and the advance ruling registry number is listed on the import declaration form

■ Wholly obtained or produced good status can be ascertained from invoices and other documents.

(When applicable, write “EPA WO” on the import declaration form in the field for attachments or additional descriptions in the NACCS System.)

*Confirmation of the originating status of the imported good is required regardless of the ability to forgo the submission of documents as per (1) or (2).