Enhancement of Controls on Gold Smuggling

1. Background

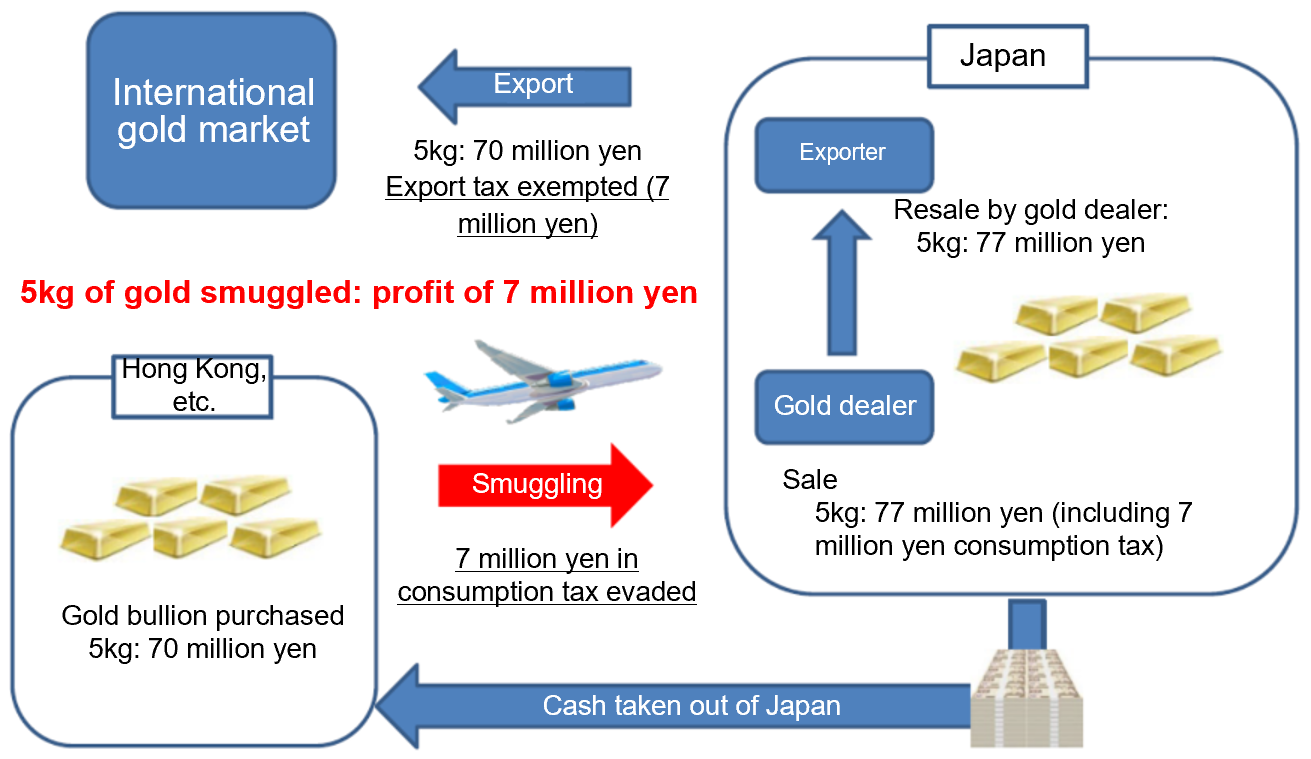

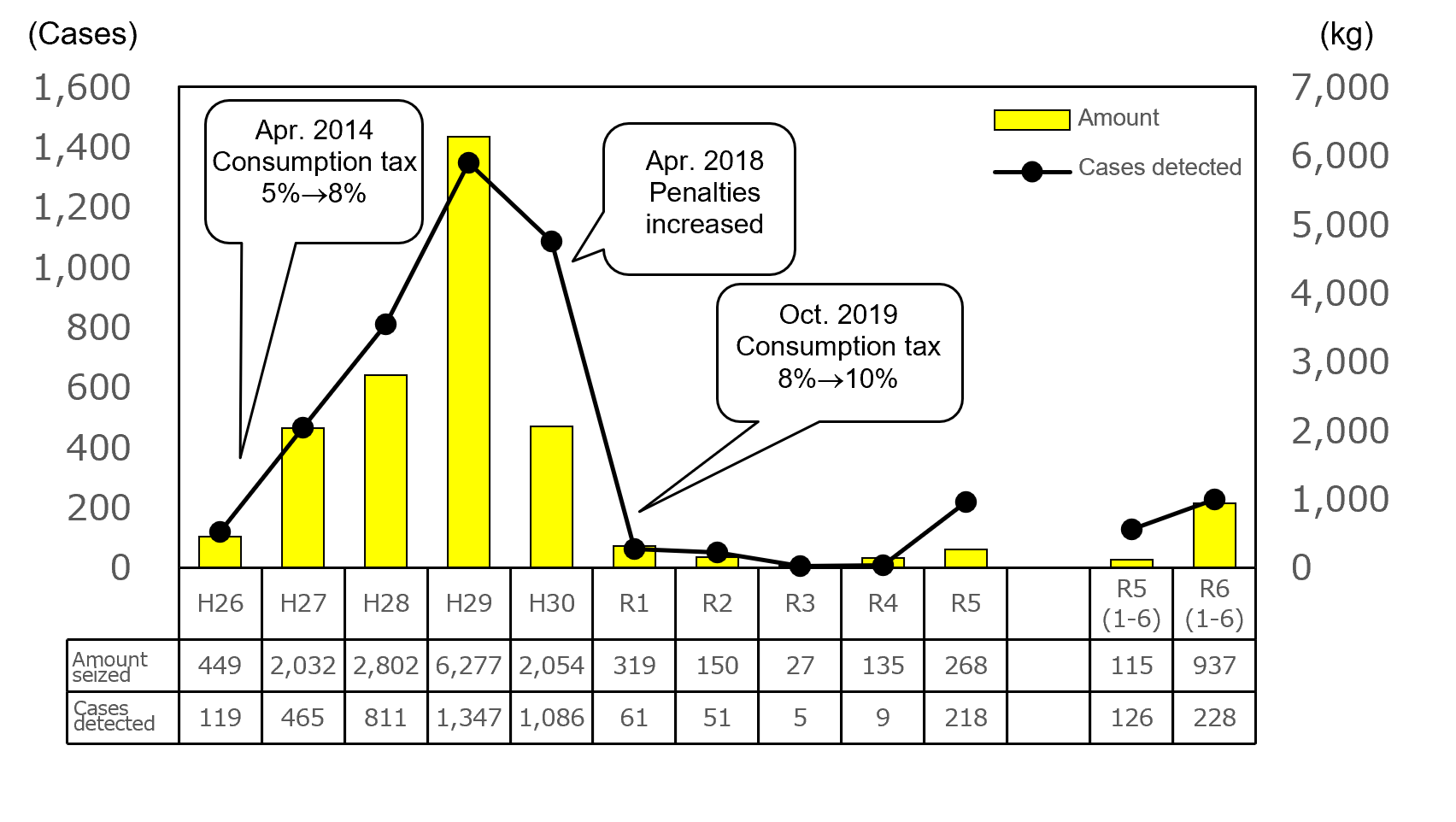

Smuggling of gold bullion (hereinafter referred to as “gold smuggling”) is carried out with the aim of avoiding the payment of domestic consumption tax by concealing gold and bringing it into Japan, then selling it to a gold purchasing business at a price that includes consumption tax, thereby acquiring the amount of consumption tax as profit. With the increase in the rate of consumption tax to 8% in April 2014, there was a sharp increase in gold smuggling, and in 2017, there were 1,347 cases of gold smuggling detected, with approximately 6.3 tons of gold seized. As an urgent measure to combat this sudden increase in gold smuggling, Customs and Tariff Bureau of Ministry of Finance formulated the “Stop Gold Smuggling” emergency measures in November 2017, and worked to implement comprehensive measures to combat gold smuggling, such as strengthening enforcement and imposing stricter penalties. As a result, the amount of gold smuggling dropped sharply the following year, and after that, with the number of people entering Japan also dropping sharply due to the COVID-19 pandemic, the number of detected gold smuggling incidents remained at a very low level.

However, recently, in addition to the rapid recovery in the number of foreign tourists visiting Japan, the rise in the price of gold has also led to an increase in the illicit profits to be gained from evading domestic consumption tax. For this reason, the number of gold smuggling cases detected and the amount of gold seized have increased rapidly again. During the period from January to June 2024, the number of cases detected increased by 81% relative to the same period of the previous year, while the amount of gold seized increased approximately eight-fold.

In addition, in recent years, there has been a proliferation of new smuggling methods, such as cases where passengers hide gold that they have processed on their person, and cases where gold is skillfully concealed in sea and air cargo. While Customs is detecting cases of gold smuggling, a considerable amount of gold is still being smuggled, and there is a risk that the profits generated by this are being funneled to criminal organizations. With the number of foreign tourists visiting Japan and the volume of imported goods expected to increase further, enhancing measures to combat gold smuggling has become a pressing issue.

<Detected cases of gold smuggling>

Ex. 1 [Air passenger]

Powdered gold found hidden on the passenger's person

Ex. 2 [Air cargo]

Gold found concealed in fake IC chips

Ex. 3 [Sea cargo]

Gold found concealed in compressors

2. Response

In light of the current situation regarding gold smuggling, Customs and Tariff Bureau of Ministry of Finance and Japan Customs held a special meeting of Directors-General of Customs on November 28th, and the Director-General of Customs and Tariff Bureau instructed the Directors-General of Customs to further tighten border controls on gold smuggling at customs. In addition, Customs and Tariff Bureau and Japan Customs will continue to consider ways to conduct more thorough inspections of passengers and import cargo, such as by equipping inspectors with equipment capable of detecting hidden gold, and will also take further strict measures against gold smuggling through investigations of violations, with the aim of enhancing the deterrent effect by imposing economic disadvantages on such smuggling.

<Images of the inspection equipment to be provided>

3. Conclusion

Under the Customs Act, the penalties for gold smuggling include a maximum of five years’ imprisonment with work, a fine of up to five times the value of the gold, or both. Customs and Tariff Bureau and Japan Customs will take firm actions to combat gold smuggling.

We ask that the general public, with a renewed awareness of the seriousness of the current situation regarding gold smuggling, understand the necessity of measures such as enhanced inspections by Customs, and cooperate further with the work of Customs, such as by providing information on smuggling.

(Reference)

![Customs Channel[YouTube]](/english/common2018/img/banner-youtube.jpg)