Information on import procedures for postal items arriving from foreign countries

![]()

Information on import procedures for postal items arriving from foreign countries to Chubu International Post Office

��This document is a provisional translation for reference, and the original text is in Japanese.

Click here for the official text in Japanese.

�� For those who have received a postcard with “Notice of Customs Clearance Procedure for Postal Matters from Abroad”

�i�P�jAbout Customs procedures

�i�Q�jRegarding “Information(�A������)” section of the postcard

(1. Quantity of mail items, shipping costs, and product prices)

(11. Pharmaceuticals and Medical Devices Act)

(15. Food Sanitation Act)

(22. Weapons)

�� Frequently asked questions�i�p���`�j

�@�p�P�DWhat is the process for receiving (importing) mail (imported mail) arriving from foreign countries?

�@�p�Q�DFrom what price do we have to pay tax?

�@�p�R�DWhat should I do if I receive a "Notification of an international mail item that may require an import (tax payment) declaration"?

�@�p�S�DWhat should I do when I receive the "Notice of Commencement of Verification Procedures�i�F��葱�J�n�ʒm���j"?

�p�T�D What should I do if the mail sent from abroad does not arrive"?

�� Reference materials regarding customs clearance procedures for international mail

�� For those who have received a postcard with “Notice of Customs Clearance Procedure for Postal Matters from Abroad”

- For international items* that arrives at the Chubu International Post Office (international exchange bureau) from a foreign country and requires Customs procedures, Customs sends a postcard to the addressee (“Notice of Customs Clearance Procedure for Postal Matters from Abroad”).

�@�@�@Ishikawa, and Toyama prefectures.

- Customs procedures (import procedures) written on the postcard are required in order to receive (import) international postal items.

- Please read the “Information(�A������)”section of the postcard carefully and respond (submit) by mail (reply postcard, sealed letter, etc.) or FAX:0569-38-1525. When responding (submitting), please be sure to include the notification number and daytime contact information (name and phone number) listed on the postcard. In principle, Customs does not accept responses (submissions) by phone or email.

- If the import procedures are not completed within one month from the date the postcard is sent, the goods will be returned to the sender, so please complete the procedures as soon as possible.

- For inquiries regarding the delivery status of international mail, delivery requests, etc., please contact your nearest post office.

�@�@"Track & Trace Service" Please refer to Q5 of Frequently Asked Questions (Q&A).

- If you are unsure about Customs procedures regarding mail, please contact the Overseas Mail Customs Sub-Branch Office written on the postcard.

�i�Q�j Regarding “Information(�A������)” section of the postcard

�@(�P. Quantity of mail items, shipping costs, and product prices)

In order to calculate taxes such as customs duties, you need to clarify the intended use of the product, price, etc.�@�@�@�@�@�@

�@Please write the intended use of the product, purpose of purchase, etc. on a return postcard or documents and submit it.(Example: for samples, sales, joint purchases, proxy purchases, etc.)

�APlease submit documents (invoices, receipts, order forms, a copy of the screen showing the price when ordering online, etc.) that show the number of postal items,shipping costs, and product prices.

�@(11. Pharmaceuticals and Medical Devices Act)

There are some items that may be considered to be pharmaceuticals, quasi-drugs, medical devices, cosmetics, etc. Some of these items cannot be imported or there are restrictions on quantity, so it is necessary to inquire (or complete procedures) with the competent government agency.

�@Please contact the number below by phone. At that time, please provide the "notification number" written on the postcard.

�AIf an "Import Confirmation Certificate�i�A���m�F�j" has been issued, please submit it to Customs.

�BIn cases other than �A above (such as when procedures are not required), please notify Customs of the results of your inquiry by phone.

[Contact for inquiries regarding the Pharmaceuticals and Medical Devices Act]

Kinki Regional Bureau of Health and Welfare�@

Phone number: 06-6942-4096

Reception hours: Weekdays (excluding year-end and New Year holidays) 9:30-12:00, 13:00-17:00

Kinki Bureau of Health and Welfare Homepage

There are some items that may be considered to fall under the Food Sanitation Act, such as foods, additives, utensils, and toys.When importing these items, procedures may be required, so please contact the competent government agency.

�@ Please check the homepage and complete necessary procedures.�@�@�@

After reading the contents of the international postal items on the homepage of Chubu Airport Quarantine Station,download the inquiry sheet and submit it to the Quarantine Station by FAX or email.

�A If a "Notification for Food Quarantine�i�A���H�i���͏o�j" has been issued, please submit it to Customs.

�B In cases other than �A above (such as cases where procedures are not required),please let Customs know the result of the inquiry by phone or reply postcard.

[Contact for inquiries regarding the Pharmaceuticals and Medical Devices Act]

Chubu Airport Quarantine Station Branch

Phone number: 0569-38-8195

Chubu Airport Quarantine Station Branch Home Page

There are some items that may be considered to be weapons that fall under the Foreign Exchange and Foreign Trade Act.

�@ If you have an import approval document�i�A�����F���j, please submit the import approval document (original). Please include a reply envelope with stamp as the import approval document will be returned after confirmation.

�A If you do not have an import approval document (original), please complete the necessary procedures and submit the import approval document(original).Please include a reply envelope with stamp as the import approval form will be returned after confirmation.

�B If you receive an answer that import approval is not required, please let Customs know the name of the person in charge and the reason why it is not necessary by return postcard or telephone.

�CFor details and specific procedures regarding import approval, please contact the competent government agency below.

[Contact for inquiries regarding import approval]

(1) Inquiry by phone

Ministry of Economy, Trade and Industry

Trade and Economic Cooperation Bureau

Phone number: 03-3501-1659

(2) Inquiry regarding the necessity of import approval via WEB

Ministry of Economy, Trade and Industry homepage

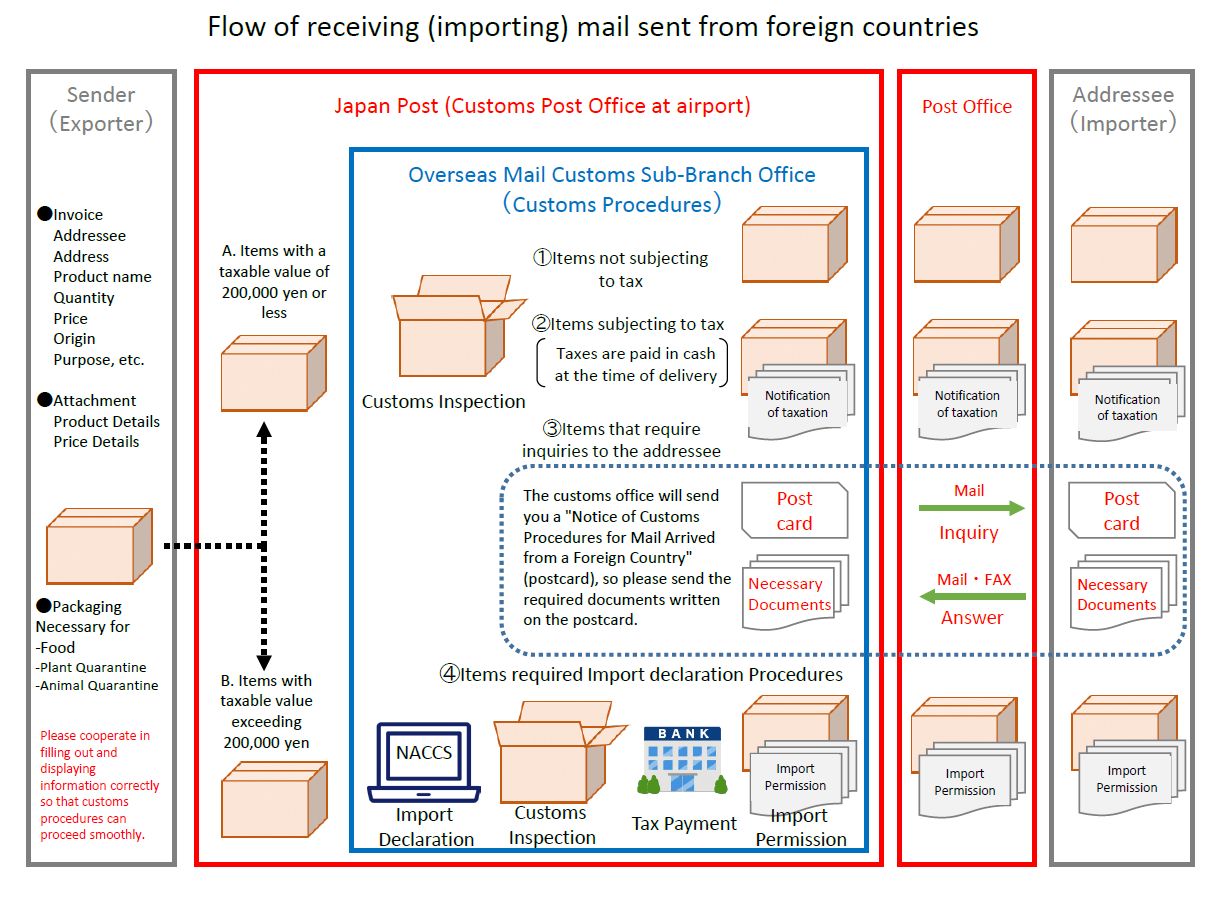

�p�P�DWhat is the process for receiving (importing) mail (imported mail) arriving from foreign countries?

�`�DAll mail items arriving from foreign countries, except for letters, are subject to Customs examination and inspection.

The mail can be divided into followings. �@

�@Items with a taxable value of 200,000 yen or less that are not subject to tax �@

�AItems with a taxable value of 200,000 yen or less that are subject to tax �@

�BItems that require inquiries to the addressee

�CItems with taxable value exceeding 200,000 yen and require import procedures

Please note that items �@ and �A do not require an import (tax payment) declaration to Customs,item �B will be categorized into �@, �A, or �B according the answer.

The outline is shown below.

�@�@�@�@

�@

�p�Q�DFrom what price do we have to pay tax?

�`�@�DAs a general rule, if the taxable price (the price that is the basis for tax calculation, which is the price of the product plus shipping costs, etc.) exceeds 10,000 yen, taxes such as customs duties and consumption tax will be charged. However, tax may be charged even if the taxable value is less than 10,000 yen. (For details, please refer to Customs Answer 1006 (Duty exemption for goods at a total customs value of 10,000 yen or less).

�p�R�DWhat should I do if I receive a "Notification of an international mail item that may require an import (tax payment) declaration"?

�`�@�DIn principle, if the taxable value exceeds 200,000 yen, an import declaration procedure is required. Please contact Japan Post Co., Ltd. listed in the notice.

�p�S�D What should I do when I receive the "Notice of Commencement of Verification Procedures�i�F��葱�J�n�ʒm���j"?

�`�@�D Please carefully read the documents enclosed with that Notification and complete Customs procedures. (For more information, please refer to Customs Answer 2003 (System of an application for suspension of the importation of those goods infringing intellectual property rights)

�p�T�DWhat should I do if the mail sent from abroad does not arrive?

�`�@�DPlease check the delivery status by "Track & Trace Service" of Japan Post Co., Ltd.

Track & Trace Service - Japan Post .

�� Reference materials regarding customs clearance procedures for international mail

List of Custom answers (on Customs website) (extract)

�U�|�P�DHow to Receive Postal Items from Abroad

6101�@�@ Outline of Customs Procedures for International Postal Items

6102 �@�@How to interpret the "Notice of Customs Clearance for International Mail" and related procedures

6103 �@�@How to Interpret the Assessment Notice of International Mail and Subsequent Procedures

6104 �@�@When the Price of an International Postal Article is Unknown

6105 �@�@Customs Procedures for International Parcels that has been bought as Souvenirs (Unaccompanied Baggage)

6106�@�@Contacts for Inquiries Regarding Undelivered or Damaged International Postal Articles

6107 �@�@Time Limit for Import Clearance for Mail Articles Delivered from Overseas

�U�|�Q�DHow to Send Postal Articles Overseas

6201�@�@ Procedures for Sending Postal Articles Overseas