Step 2: Confirm that the good was produced in a Party and is treated as an originating good under the RCEP Agreement

Requirements for originating status (Article 3.2)

To be treated as an originating good under the RCEP Agreement, the good intended for import must have undergone a certain degree of production in a Party. This requirement is satisfied if the good qualifies under one of the following three categories.

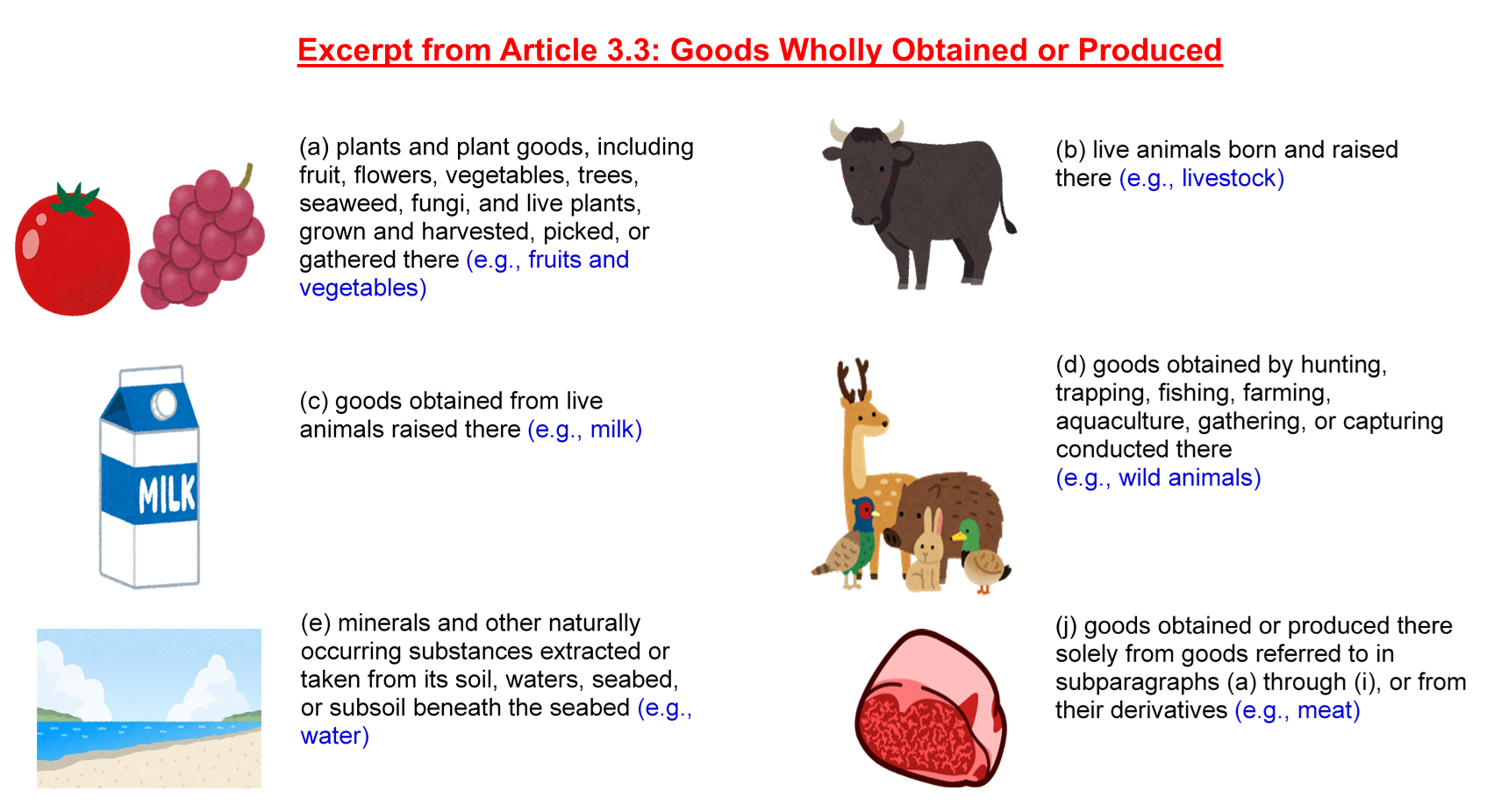

- (a) A wholly obtained or produced good (Article 3.2 (a))

- (b) A good produced exclusively from originating materials (Article 3.2 (b))

- (c) A good which satisfies the applicable Product-Specific Rule (Article 3.2 (c))

(a) A wholly obtained or produced good (Article 3.2 (a))

Refers to goods wholly obtained or produced in a Party in accordance with the stipulations of Article 3.3 of the RCEP Agreement.

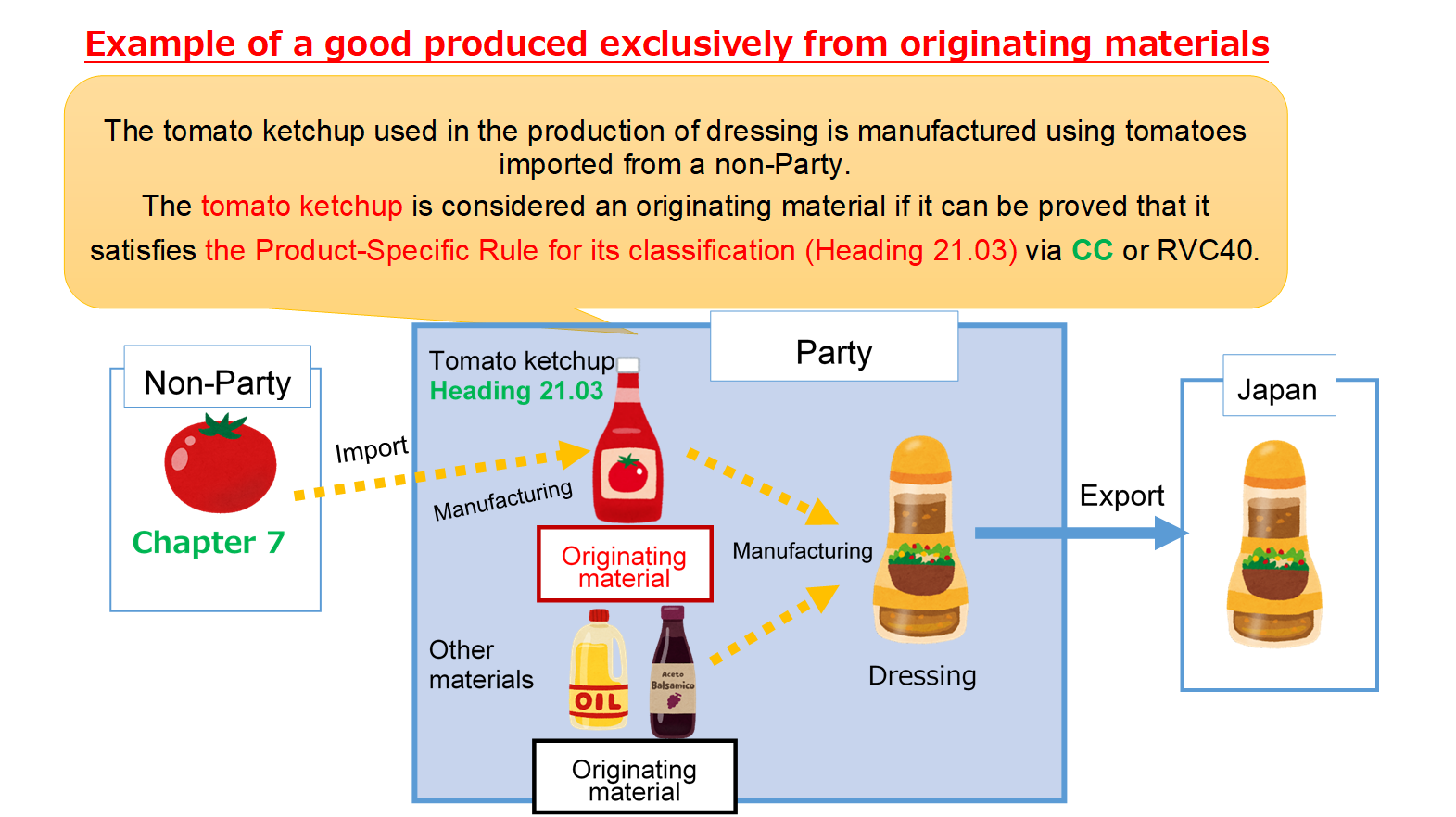

(b) A good produced exclusively from originating materials (Article 3.2 (b))

Refers to goods produced in a Party exclusively from originating materials from one or more of the Parties.

Originating materials

The term originating materials refers to originating goods used as materials for the production of another good in a Party. Accordingly, any originating material used in the production of a good must meet the requirements of one of the following three categories of originating goods.

- (a) A wholly obtained or produced good (Article 3.2 (a))

- (b) A good produced exclusively from originating materials (Article 3.2 (b))

- (c) A good which satisfies the applicable Product-Specific Rule (Article 3.2 (c))

The phrase “produced exclusively from originating materials” refers to any good whose production is completed through the sole use of originating materials as materials.

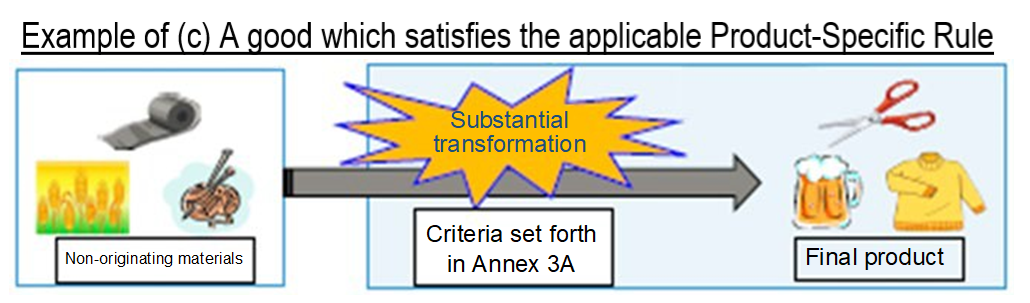

(c) A good which satisfies the applicable Product-Specific Rule (Article 3.2 (c))

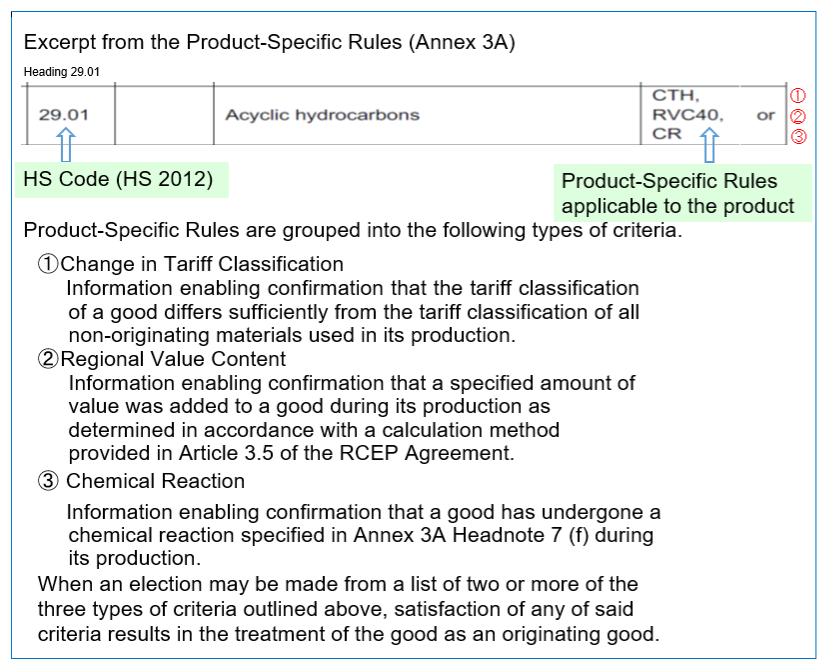

Refers to goods that are produced with non-originating materials and which satisfy the criteria set forth in Annex 3A (Product-Specific Rules). There are three criteria which may be used to satisfy Product-Specific Rules, identified below with ①, ② and ③.

Non-originating materials

Non-originating material is a term which refers to any good which is used as a material in the production of another good and which is not qualified as originating under the RCEP Agreement.

Product-Specific Rules (Annex 3A)

Product-Specific Rules are compilations of criteria, grouped by HS Code, which govern when a product produced with non-originating materials is treated as an originating good. The RCEP Agreement provides these stipulations in Annex 3A.

【Product-Specific Rules (Annex 3A)】

【Search for Product Specific Rules】

*Irrespective of satisfaction of the Product-Specific Rules, a good is not considered an originating good if the operations performed in a Party on its non-originating materials are simple in nature (minimal operations and processes). (Article 3.6)

Reference: Minimizing the effort required to evidence originating status

Demonstrating that a good meets the requirement “(b) a good produced exclusively from originating materials” requires the furnishing of proof that all materials used in the final stage of its production are originating goods.

In comparison, demonstrating that a good meets the requirement “(c) a good which satisfies the applicable Product-Specific Rule (PSR)” may require less effort than demonstrating that all materials used in the final stages of the production of the good are originating goods.

Example

Importing pickles (Subheading 2001.90) produced in Thailand under the preferential tariff rates available through the RCEP Agreement.

■Cucumbers, Onions and Carrots (Chapter 7)

■Salt (Heading 25.01)

■Vinegar (Heading 22.09)

Method 1: Demonstrating that the pickles are indeed originating goods of Thailand under the RCEP requirement of “(b) a good produced exclusively from originating materials” requires the furnishing of proof that all of the materials used in the final stage of production (i.e., the cucumbers, onions, carrots, salt and vinegar) are in fact originating materials (i.e., originating goods under the RCEP Agreement); accomplishing this requires information (documents) attesting to that fact.

Method 2: If all of the materials are considered* to be non-originating goods of Thailand, and all of the materials meet the applicable Product-Specific Rules, the pickles will be considered originating goods of Thailand under the RCEP requirement of “(c) a good which satisfies the applicable Product-Specific Rule.”

*Materials may be considered non-originating goods even in the presence of information which demonstrates that said materials are originating materials.

A difference in the HS Code of the good and its constituent materials (a Change in Chapter (CC)) is the requirement for originating good status under Method 2. Although demonstrating this difference does require the identification of the HS Codes for the good and all of its constituent materials, this method—unlike Method 1—does not require the furnishing of information attesting to the originating material status of all of the materials.

Conclusion:

Since the use of either method will result in the treatment of the goods as originating goods of Thailand under the RCEP Agreement...

Method 1: (b) A good produced exclusively from originating materials

Method 2: (c) A good which satisfies the applicable Product-Specific Rule

Selection of the method which requires a lesser burden of proof to obtain originating status is advisable.

Reference: HS Codes for use in identifying a Change in Tariff Classification

The Change in Tariff Classification rule stipulates that any good produced in a Party is considered to be an originating good when its tariff classification differs sufficiently from the tariff classification of all non-originating materials used in its production.

Demonstrating that the Change in Tariff Classification rule has been satisfied does not always require the identification of the full six-digit Subheading of the material.

Identification of the two-digit Chapter or four-digit Heading may constitute sufficient proof in some circumstances.

Example

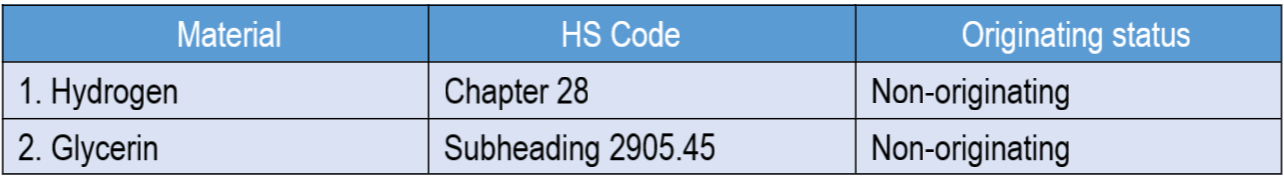

Importing food additives (Subheading 2905.32) produced in China under the preferential tariff rates available under the RCEP Agreement.

Material list

Given the use of non-originating materials (or the consideration of the materials used as non-originating materials), satisfaction of the applicable Product-Specific Rules is required for the good (a food additive) to be considered an originating good of China under the RCEP Agreement.

RCEP Agreement Product-Specific Rule for Subheading 2905.32: CTSH or RVC40

Satisfaction of either of the requirements specified under the Product-Specific Rule results in originating status. Below is an analysis of the CTSH requirement.

*CTSH: Change in the six digits of the HS code of all non-originating materials used in the finished product.

In this example, a change in the subheading must be identified for all of the non-originating materials; as such:

(1) Confirmation is only required for the first two digits of the HS Code if the material is not listed in Chapter 29.

(E.g., no further action is required if the material is listed in Chapter 28.)

(2) Confirmation is only required for the first four digits of the HS Code if the material is listed in Chapter 29 but is not listed in Heading 29.05.

(E.g., no further action is required if the material is listed in Chapter 29.01.)

(3) However, if the material is listed in Heading 29.05, identification of the six-digit subheading is needed to determine whether any changes in subheading occur between the non-originating material and the good.

(E.g., confirmation of the full subheading 2909.45 would be necessary.)