Step 1: Confirm that preferential tariff rates have been stipulated in relation to the good intended for import into Japan

Importers wishing to confirm whether preferential tariff rates have been stipulated in relation to a good intended for import can accomplish this task by utilizing the Tariff Schedule in combination with the six-digit HS Code and three-digit Subdivision assigned to said good.

HS Codes and Subdivisions

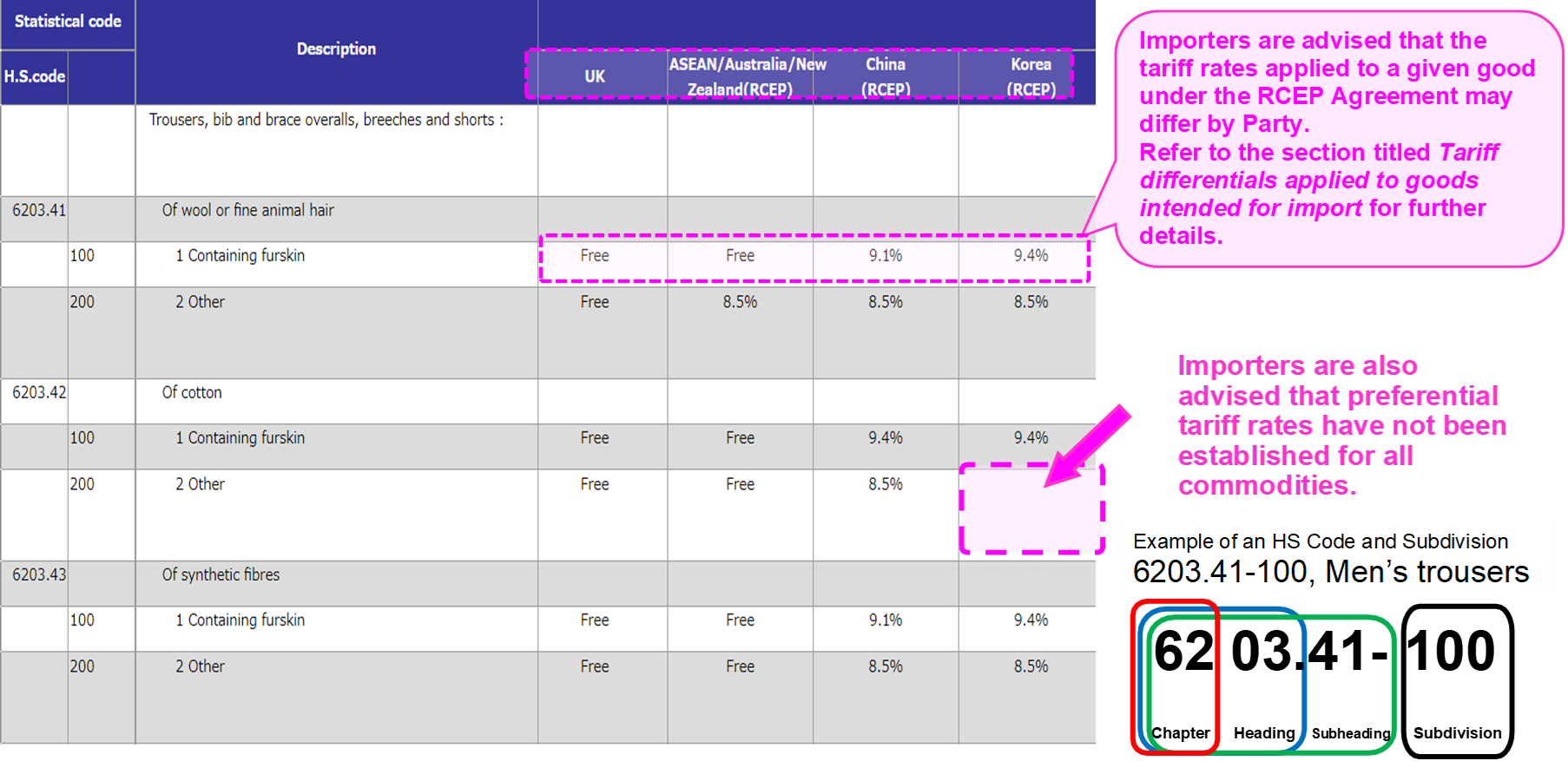

The term HS Code refers to a global system of six-digit codes assigned to goods under the World Customs Organization HS Convention (International Convention on the Harmonized Commodity Description and Coding System). The term Chapter is used to refer to the first two digits of any HS Code; the term Heading is used to refer to the first four digits of any HS Code; and the term Subheading is used to refer to the full six-digit HS Code.

The term Subdivision refers to further subclassifications of the six-digit code Subheading. In Japan, Subdivisions are expressed as additional three-digit codes.

【Outline of Tariff Classification】

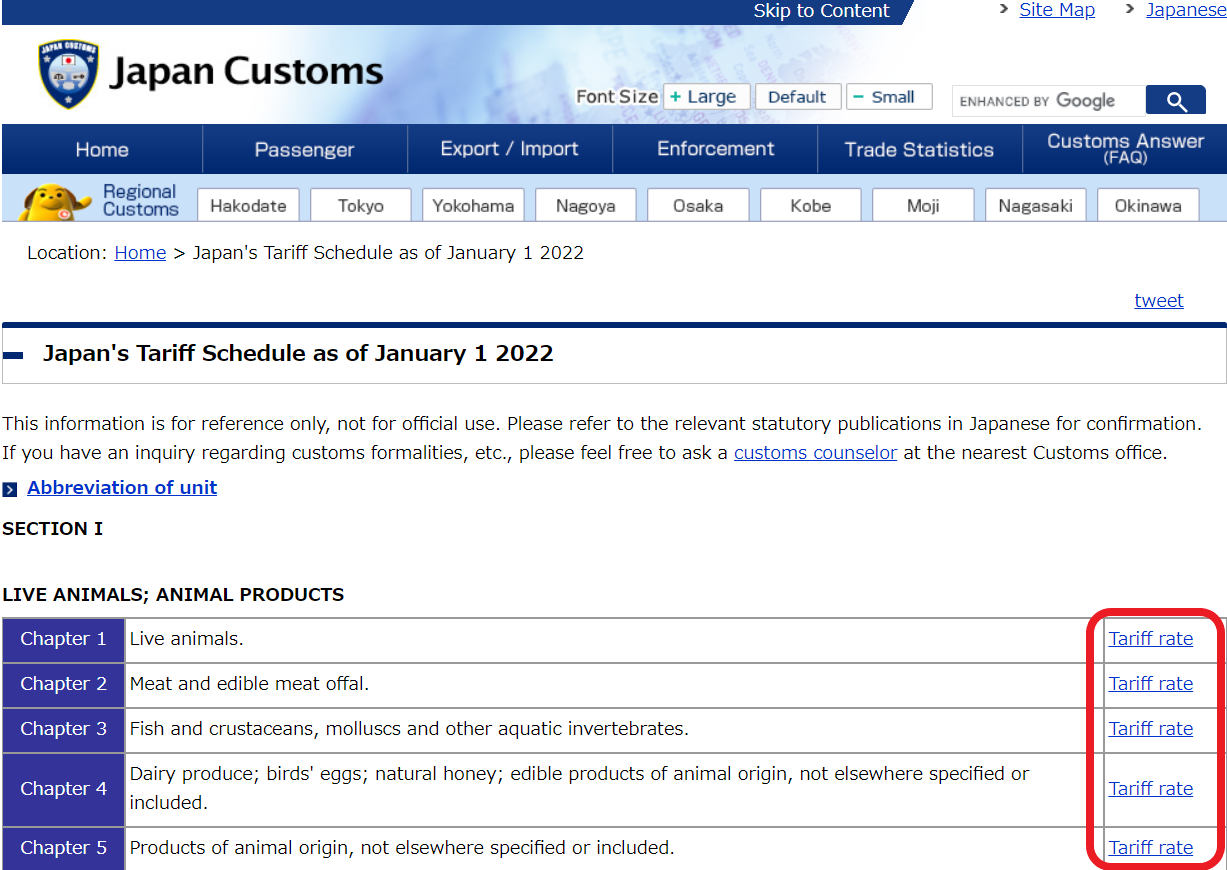

1. Visit the Japan Customs website, open the Japan’s Tariff Schedule page, and click on the “Tariff rate” hyperlink listed for the Chapter applicable to the good intended for import.

2. The “Tariff rate” page allows importers to identify the preferential tariff rates provided under Japan's trade agreements in relation to the HS Code and Subdivision of a given good

Blank cells are used to indicate commodities for which preferential tariff rates have not been stipulated, and as such the RCEP Agreement may not be used in relation to the import of that commodity.

Importers are advised to ensure that there is a preferential tariff rate stipulated in relation to any goods intended for import prior to proceeding to Step 2 to confirm whether said goods are treated as originating goods under the RCEP Agreement.

Tariff differentials applied to goods intended for import

Under the RCEP Agreement, there are three groupings of tariff rates that may be applied upon the import of goods into Japan: ASEAN/Australia/New Zealand; China; and Korea. The tariff rates applied to certain products may thus differ by Party, even when imported under an identical commodity classification. These differences in tariff rates are referred to using the term “tariff differentials”.

In the event that tariff differentials have been stipulated in relation to a good intended for import, importers are advised to identify the tariff rates applicable according to the RCEP Country of Origin. Further details regarding the RCEP Country of Origin are provided under Step 3.

When the HS Code and Subdivision of a good intended for import is unknown

When unsure of the HS Code and Subdivision of a good intended for import into Japan, importers are advised to contact the Customs Counselors of the regional Customs to which they intend to file an import declaration. Importers may also take advantage of the Advance Ruling system to obtain responses from Japan Customs in concern to formal inquiries.