3103 Importation of Tobacco(FAQ)

Anyone intending to import tobacco, including cigarettes and cigars, for sale is required to file registration as a Specified Distributor with the Ministry of Finance.

If the customs procedure is conducted through NACCS to import tobacco, including cigarettes and cigars for sale, not only an application for customs issued importer/exporter code but also registration as a Specified Distributor with the Ministry of Finance is required.

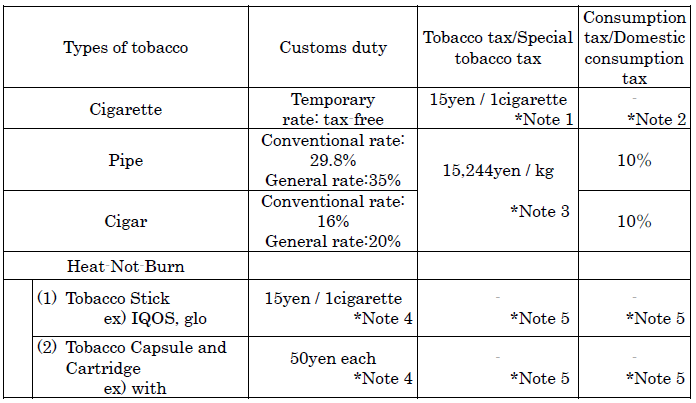

When an entrant imports tobacco as accompanied or unaccompanied goods for personal use and the quantity exceeds the tax-free allowance, a custom duty and others are levied. The tariff schedule is below.

| *Note 1 | Due to exceptional treatment of rate on tobacco tax and others on cigarettes imported by entrants. |

| *Note 2 | The cigarettes to which the above exceptional treatment rate is applied are free of consumption taxes. |

| *Note 3 | Please refer to Tabacco Tax Law Article 10 for how to convert Pipe and Cigar to Cigarette. |

| *Note 4 | Simplified tax rate for Heat-Not-Burn tobaccos imported by entrants |

| *Note 5 | Heat-Not-Burn tobaccos subject to simplified tax rate are not subject to tobacco tax, special tobacco tax, consumption tax, or domestic consumption tax. |

When importing via international parcel delivery, general cargo, or international mail if the total customs value is 10,000 yen or less, customs duty and consumption tax shall be exempted. However, tobacco tax and special tobacco tax are not exempted even if the total customs value is 10,000 yen or less or if the goods are re-imported.

For consultations on customs procedures, please contact the nearest Customs Counselor.

Please see No. 9301 for inquiries.