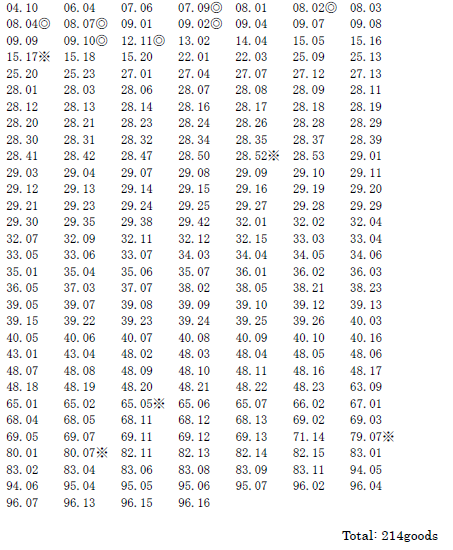

1505 List of Goods (HS Code) Made Possible to Submit the Certificate of Origin (FAQ)

As for the above goods marked “*”, only the following goods are exempted from submitting the Certificate of Origin.

・ 1517.90-1-(1)and 1517.90-2-(1)out of 15.17

・ Goods other than mercury carbides or organo-inorganic compounds out of 28.52

・ Goods other than hats of felt out of 65.05

・ 7907.00-2 out of 79.07

・ 8007.00-4 out of 80.07

You will need submission of the certificate of origin for the following goods originating from Least-Developed Countries out of the above goods marked “◎”.

0709.30-000 0709.51-000 0709.52-000 0709.53-000 0709.54-000

0709.59-000 0709.60-010 0709.60-090 0709.99-100 0709.92-000

0709.93-000 0709.99-200 0802.31-000 0802.32-000 0802.41-000

0802.42-000 0802.70-000 0802.91-000 0802.92-000 0802.99-900

0804.30-010 0807.11-000 0807.19-000 0902.10-000 0902.20-200

0902.30-090 0902.40-220 0910.11-100 0910.12-100 1211.40-000

1211.90-600

You will need submission of the certificate of origin for the above goods in the following cases:

- Paragraph 2, Article 26, Paragraph 1 Article 30 of the Cabinet Order for Enforcement of the Temporary Tariff Measures Law is applicable (materials originating from Japan is used)

- Paragraph 3, Article 26, Paragraph 3 Article 30 of the Cabinet Order for Enforcement of the Temporary Tariff Measures Law is applicable (cumulative processing)

- Goods is imported via third countries from a country of origin (excluding if the document specified in Paragraph 3, Article 31 of the Cabinet Order for Enforcement of the Temporary Tariff Measures Law)

For consultations on customs procedures, please contact the nearest Customs Counselor.

Please see No. 9301 for inquiries.