1111 Calculation Method of Amount of Tariff Duty, Consumption Tax, etc

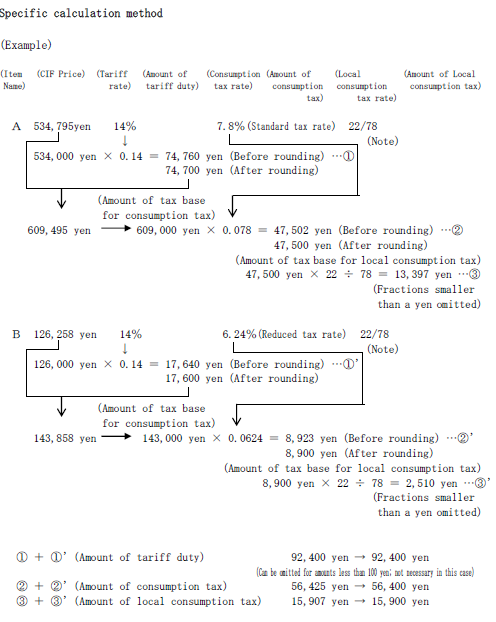

| Tax rate | Standard tax rate | Reduced tax rate |

|---|---|---|

| National Consumption Tax rate | 7.8% | 6.24% |

| Local Consumption Tax rate | 2.2% (22/78 of National Consumption Tax) |

1.76% (22/78 of National Consumption Tax) |

| Total | 10% | 8% |

Relevant information

・Japan's Tariff Schedule ( Statistical Code for Import )

・1403 Primary Method to Determine the Customs Value of Imported Goods

・1406 Foreign Exchange Rate for Conversion of Currency

For consultations on customs procedures, please contact the nearest Customs Counselor.

Please see No. 9301 for inquiries.